China digs in on ‘rare earth’, commands global market

GEOGRAPHY – RESOURCES

10 SEPTEMBER 2025

- In August 2025, China’s Ministry of Industry and Information Technology introduced interim measures to tighten controls on ‘rare earth’ mining and processing.

- The rules are the latest in Beijing’s efforts to centralise oversight of extraction, exports, and refining.

- While China’s trading partners such as India and the U.S. are seeking alternative sources to reduce dependency, data shows that China’s dominance in rare earths stems not only from resource availability but more so from its longstanding strength in mining and research capacity.

- In December 2023, China banned the export of processing technology.

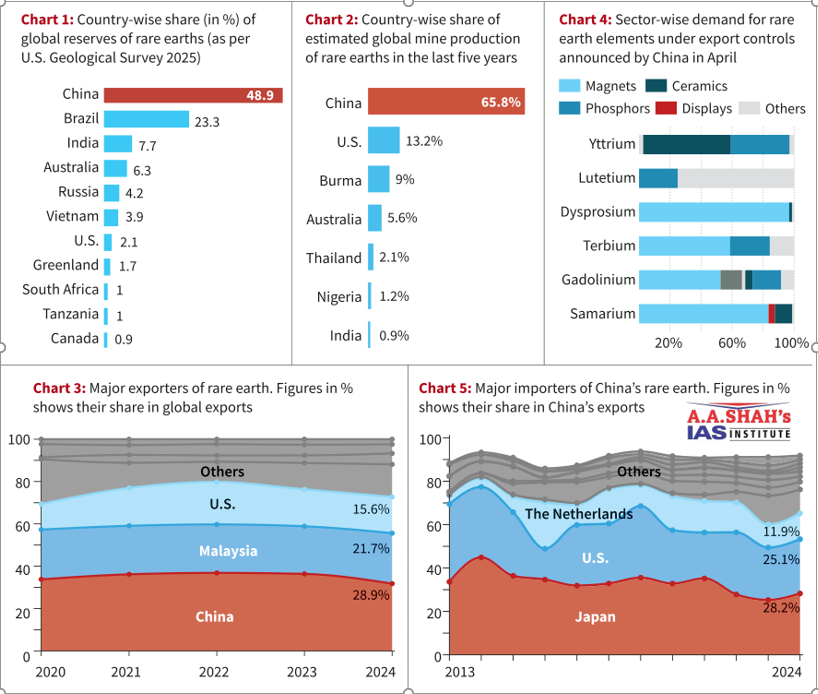

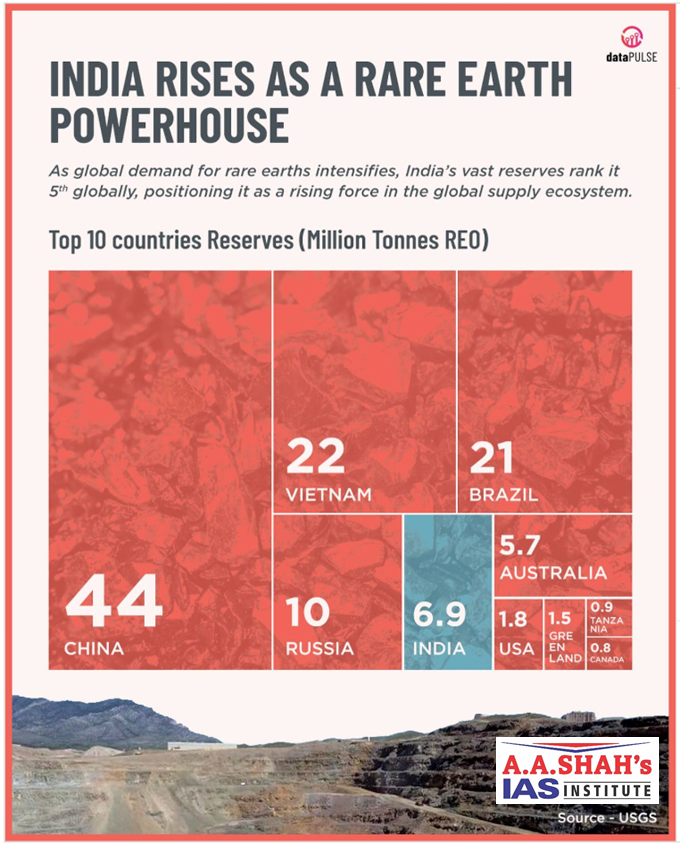

- Although rare earth deposits exist in countries such as Brazil, Australia, and India, China holds nearly half of global reserves.

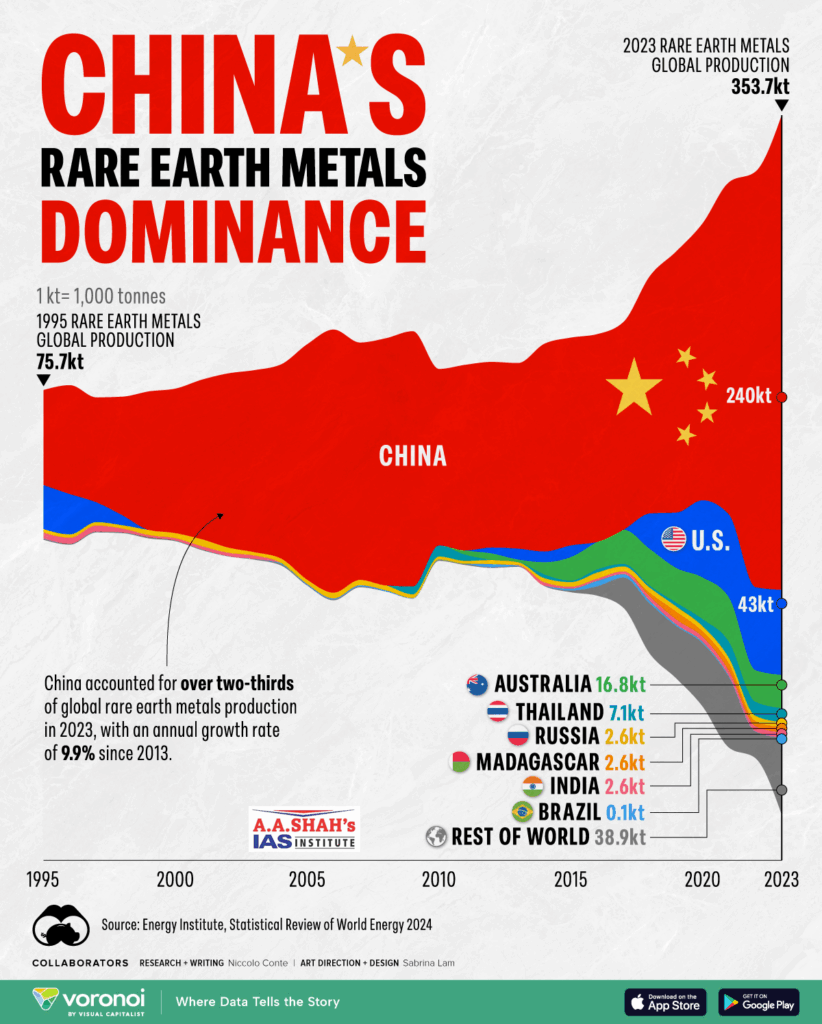

- It is also the world’s largest producer, contributing over 60% of global production in the last five years.

- Beyond extraction, China dominates the value chain with around 92% of global refining capacity.

- Moreover, in the last five years, China has been the largest exporter, supplying close to 30% of global demand.

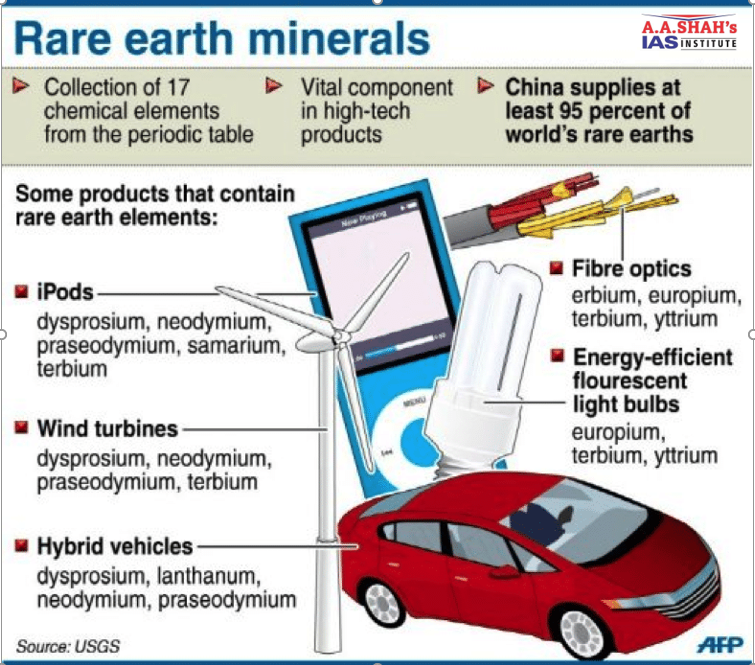

- Rare earth elements (REEs), despite the name, are not particularly scarce. They are moderately abundant in nature but not concentrated enough to make them economically exploitable.

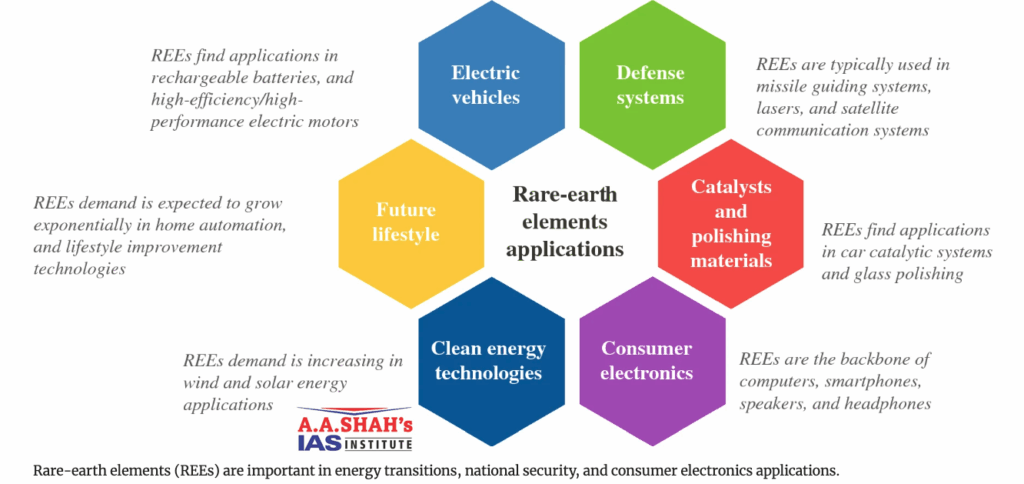

- They are critical components in clean energy technologies such as electric vehicles and wind turbines, as well as in defence applications.

- Rare earths are also essential for high-tech devices including smartphones and hard drives.

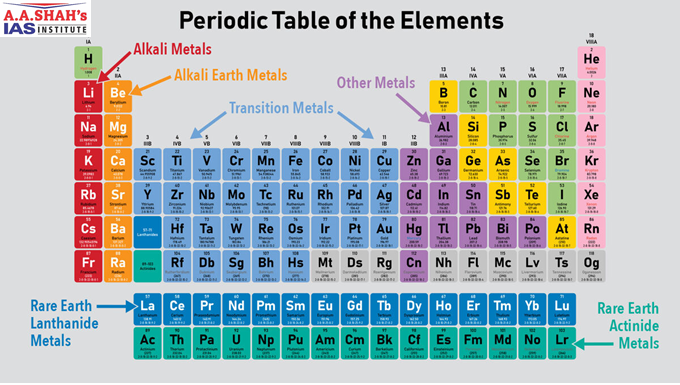

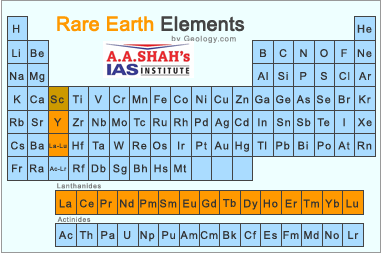

- According to the International Energy Agency (IEA), they comprise 17 metals, in Group 3 of the Periodic Table comprising Lanthanide series, typically grouped into light rare earths (LREEs) — including lanthanum, cerium, praseodymium, neodymium, samarium and europium — and heavy rare earths (HREEs) such as gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium, scandium and yttrium.

- Promethium is not included in the list as it is radioactive and does not occur in mineable quantities.

- Rare earth elements such as europium, terbium, and yttrium are integral in the production of phosphors used in display technologies. These phosphors emit specific colours when excited by electrons, enabling the vivid displays in flat-screen televisions and computer monitors.

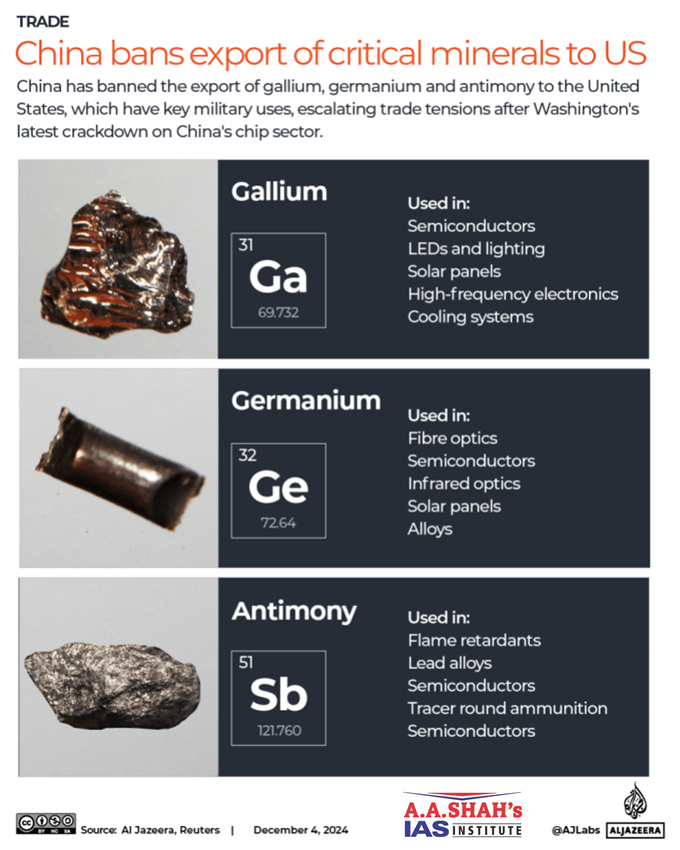

- In April 2025, amid escalating U.S.-China trade tensions, Beijing imposed export restrictions on seven rare earth elements.

- The move targeted elements used in neodymium–iron–boron (NdFeB) magnets — essential for clean energy technologies — as well as those critical to ceramics, phosphors, steel, optical glass, fibres, and aerospace applications

- China’s decision to curb rare earth exports, amid tit-for-tat tariffs, dealt a significant blow to the U.S., which remains heavily dependent on Chinese supply.

- The U.S. is the second-largest importer of Chinese rare earths, after Japan.

- India has the third-largest rare earth resource globally, with mainly concentrated in its monazite minerals.

- Monazite is a radioactive atomic mineral used for the production of Thorium (as high as 500 ppm) and has the potential to be used as fuel in the nuclear power system.

- The major monazite reserves are concentrated in Tamil Nadu, Kerala, Andhra Pradesh, Odisha, and Maharashtra.

- India, too, is heavily dependent on China for its rare earth imports. Since 2021, more than 75% have come from China.

- Rare earth minerals are also present on the seafloor, particularly in international waters beyond national jurisdictions.