Households are piling on debt faster than creating assets, RBI data show

ECONOMY – INDICATORS

2 NOVEMBER 2025

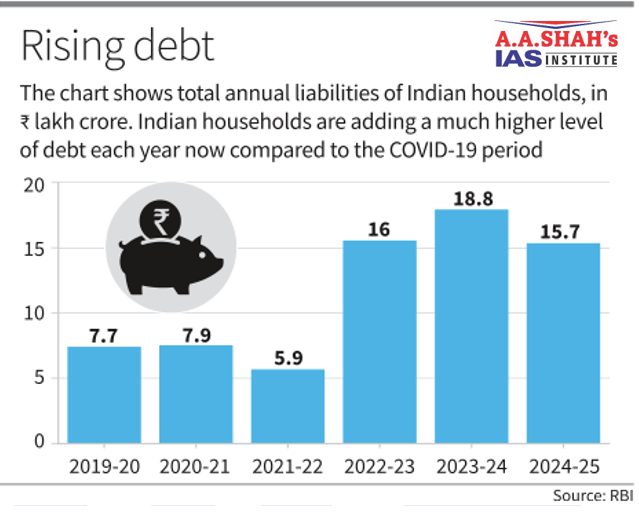

- The annual financial debt accumulated by Indian households has grown faster than their annual financial assets since the pre-pandemic year 2019-20, an analysis of Reserve Bank of India data has found.

- The amount of financial assets added each year has grown 48% between 2019 and 2025, while the annual liabilities have grown 102% over that period.

- Even as a percentage of Gross Domestic Product (GDP), the annual financial asset addition is lower this year than before the pandemic, while the annual liabilities added are higher.

- While, bank deposits have remained the main destination for household savings, mutual funds have seen their share grow rapidly over the last few years.

- Households added ₹24.1 lakh crore to their financial assets in 2019-20, which grew to ₹35.6 lakh crore in 2024-25, the latest period for which the RBI has released data. This is a growth of 48%.

- On the other hand, households added ₹15.7 lakh crore worth of financial liabilities to their portfolios in 2024-25, which is 102% higher than the ₹7.5 lakh crore they added in 2019-20.

- The financial assets added by Indian households each year stood at 12% of India’s GDP in 2019-20, which declined to 10.8% by 2024-25. This figure has remained largely stable at this level in the post-pandemic period.

- Financial liabilities of Indian households, on the other hand, made up 3.9% of GDP in 2019, which increased to 4.7% in 2024-25. Here, however, the situation has improved recently, with this proportion having hit a post-pandemic peak of 6.2% in 2023-24 before declining in 2024-25.